When you're dealing with financial reports that cross international lines, especially those headed for the U.S. market, getting the translation right under GAAP isn't just a box to check—it's essential for avoiding headaches down the road. GAAP, or Generally Accepted Accounting Principles, is the go-to standard here in the States, but it doesn't always play nice with other systems like IFRS, which is used pretty much everywhere else. These mismatches can create real problems for businesses, from confusing investors to triggering compliance red flags. I've seen how these discrepancies in U.S. financial standards trip up even seasoned pros, so let's break it down and look at why specialized translation services are a game-changer.

First off, understanding the key clashes between GAAP and IFRS helps explain where things often go wrong. GAAP is all about the rules—specific, detailed guidelines set by the FASB that leave little room for interpretation. IFRS, on the other hand, is more about principles, giving companies some wiggle room to apply standards based on context. This difference shows up in big ways. For instance, how you handle inventory: GAAP lets you use LIFO, where the last items in are the first out, which can be handy for taxes when prices are rising. But IFRS says no to LIFO outright, sticking to FIFO or averages instead. If you're translating an IFRS report into GAAP without catching this, your cost figures could be way off, messing with profit margins.

Then there's the way assets get valued. Under IFRS, you can revalue things like buildings or equipment to current market prices, which might bump up your balance sheet if values have climbed. GAAP? It's strict on sticking to what you originally paid, minus depreciation—no routine mark-ups allowed. Imagine a company with overseas properties; a straight translation could make their U.S. filings look inflated or undervalued, leading to questions from auditors or shareholders.

Leases are another hotspot. Both standards now push for putting leases on the balance sheet, but GAAP draws a sharper line between operating and finance leases, which affects how expenses hit the income statement. Miss this in translation, and suddenly your debt ratios look skewed, which isn't great if you're courting lenders or investors.

To make this clearer, here's a quick side-by-side on some common sticking points:

| Category | GAAP Approach | IFRS Approach |

|---|---|---|

| Inventory Valuation | LIFO okay, along with FIFO/weighted avg. | No LIFO; FIFO or weighted average only |

| Asset Revaluation | Historical cost rules; no ups unless sold | Fair value revals allowed for PPE |

| Development Expenses | Mostly expensed right away (software excepted) | Capitalize if it meets specific tests |

| Revenue Recognition | Heavy on rules, with sector tweaks | Five-step model, more flexible |

| Balance Sheet Layout | Starts with current assets | Often kicks off with non-current |

These aren't minor quibbles. A PwC report from a couple years back highlighted that divergences like these can cause up to 20% swings in reported earnings for multinationals switching between the two. And with global investors pushing for better alignment—around 75% in surveys want more standardization—these gaps just amplify the need for precise translations.

Accuracy in these translations isn't about perfection for its own sake; it's about dodging real-world fallout. Get it wrong, and you could face SEC scrutiny, with penalties that easily hit seven figures for material misstatements. Currency conversions add another layer of risk—fluctuating rates under GAAP's ASC 830 can hide or exaggerate gains if not handled carefully. I recall a study on Asian firms where unadjusted FX impacts shaved off 4-5% of net income in volatile periods, far more than in GAAP-native setups.

Let's look at a couple of real examples to see this in action. Take the case of a German manufacturer expanding into the U.S. They had IFRS reports showing revalued machinery, but when translated to GAAP, those upward adjustments had to be stripped out. The result? A 12% drop in apparent asset values, which spooked potential partners until it was clarified. In audits, this kind of thing led to extended reviews and extra costs—KPMG estimates such discrepancies add 15-20% to audit fees for cross-border firms.

Another one: a Canadian energy company dealing with leases. Their IFRS filings treated most as operating, but GAAP reclassification pushed more to finance, inflating liabilities by millions. This shifted their debt-to-equity ratio enough to affect bond ratings. A forensic accounting review later showed that poor translation was the culprit, costing them in higher interest rates alone.

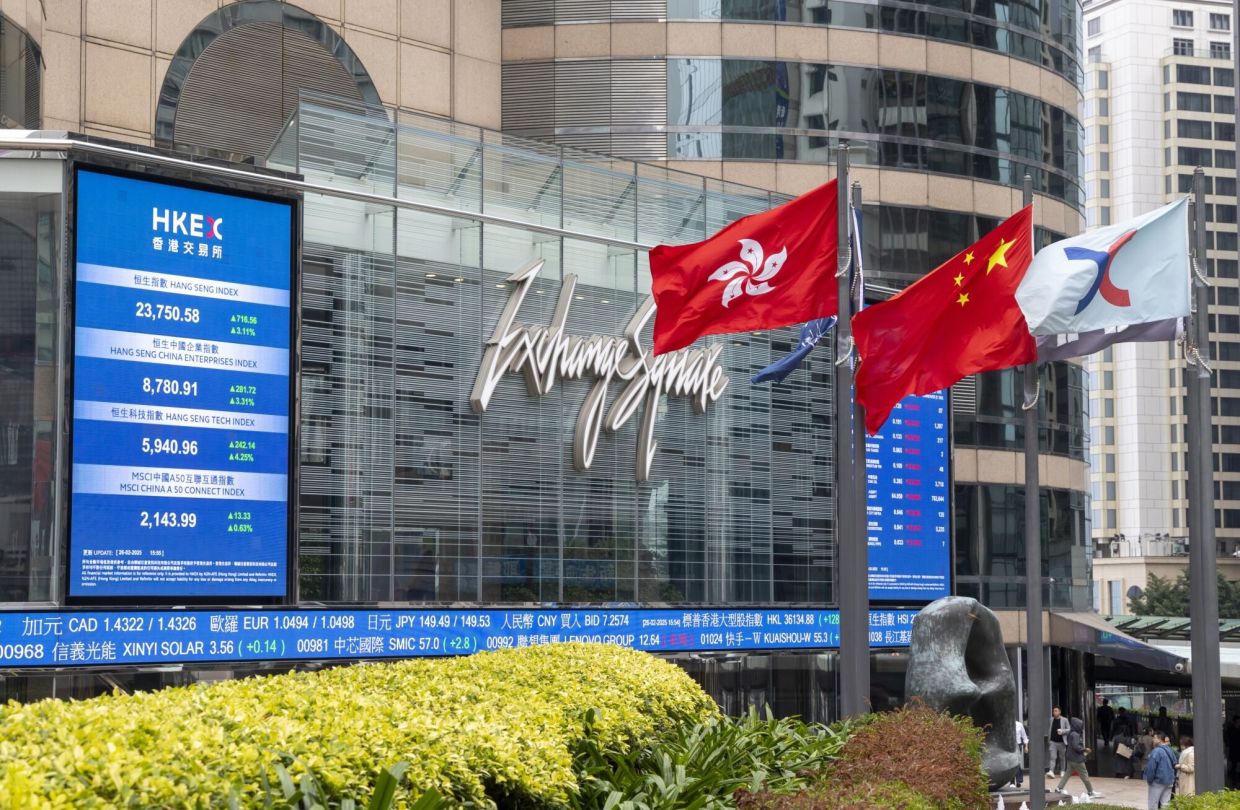

Data backs this up too. The World Federation of Exchanges notes that U.S. equities under GAAP represent over $50 trillion in market cap, and any translation slip-ups can ripple through trillions in cross-border investments. Even with convergence efforts—like the joint revenue standard—new areas like digital assets keep popping up differences, per recent FASB updates.

So, how do you navigate this? It starts with translation services that go beyond language—they need deep financial know-how to adapt, not just convert. Things like real-time exchange rate tools or dual-standard reviews can cut errors dramatically. In the end, addressing these U.S. standard discrepancies head-on keeps your reports credible and your business on solid ground.

If you're hunting for a reliable outfit to handle this, Artlangs Translation has been in the game for years, excelling in over 230 languages with a focus on everything from core translation services to video localization, short drama subtitling, game adaptations, multilingual audiobook dubbing, and data annotation. Their string of successful projects speaks for itself, making them a smart choice for turning complex financial docs into seamless GAAP-compliant versions.