Capital has a new language, and in 2025, fluency is no longer optional.

For decades, financial reports spoke in the rigid dialect of GAAP and EBITDA. Today, however, a massive shift in capital allocation is driven by Environmental, Social, and Governance (ESG) metrics. For Chinese enterprises expanding globally, the challenge isn’t just doing the good work—it is ensuring that work is understood, valued, and accurately rated by international institutions.

The difference between an "Average" and a "Leader" rating often lies not in the data itself, but in how that data is translated. It is the difference between a literal translation that confuses algorithms and a strategic narrative that resonates with institutional investors.

The "Lost in Translation" Risk: Why Terminology Matters

A major pain point for Chinese CFOs and Sustainability Officers is the discrepancy between domestic terminology and international taxonomy.

Global rating agencies like MSCI, Sustainalytics, and S&P Global do not always rely on human analysts to read every page of a report. They utilize Natural Language Processing (NLP) and AI scrapers to ingest data. If your report uses non-standard terms, these algorithms may miss your achievements entirely.

The Nuance of "信达雅" (Faithfulness, Expressiveness, Elegance) in ESG

To achieve "信达雅" in a corporate context, we must move beyond the dictionary.

The Trap of Literalism: Translating "精准扶贫" literally as "Targeted Poverty Alleviation" is accurate but dry.

The Investor-Ready Version: Framing it as "Social Impact Investment" or "Community Empowerment Initiatives" aligns it with the UN Sustainable Development Goals (SDGs), making it immediately recognizable to a London-based asset manager.

Key Insight: In 2024, data showed that companies aligning their semantic tagging with ISSB (International Sustainability Standards Board) terminology saw a 15-20% improvement in data capture rates by rating agencies compared to those using non-standard phrasing.

Navigating the Terminology Minefield: Key Examples

To secure the trust of global stakeholders, Chinese enterprises must translate their unique local initiatives into the global vernacular of sustainability.

1. Environmental (E): From "Dual Carbon" to "Net Zero Pathways"

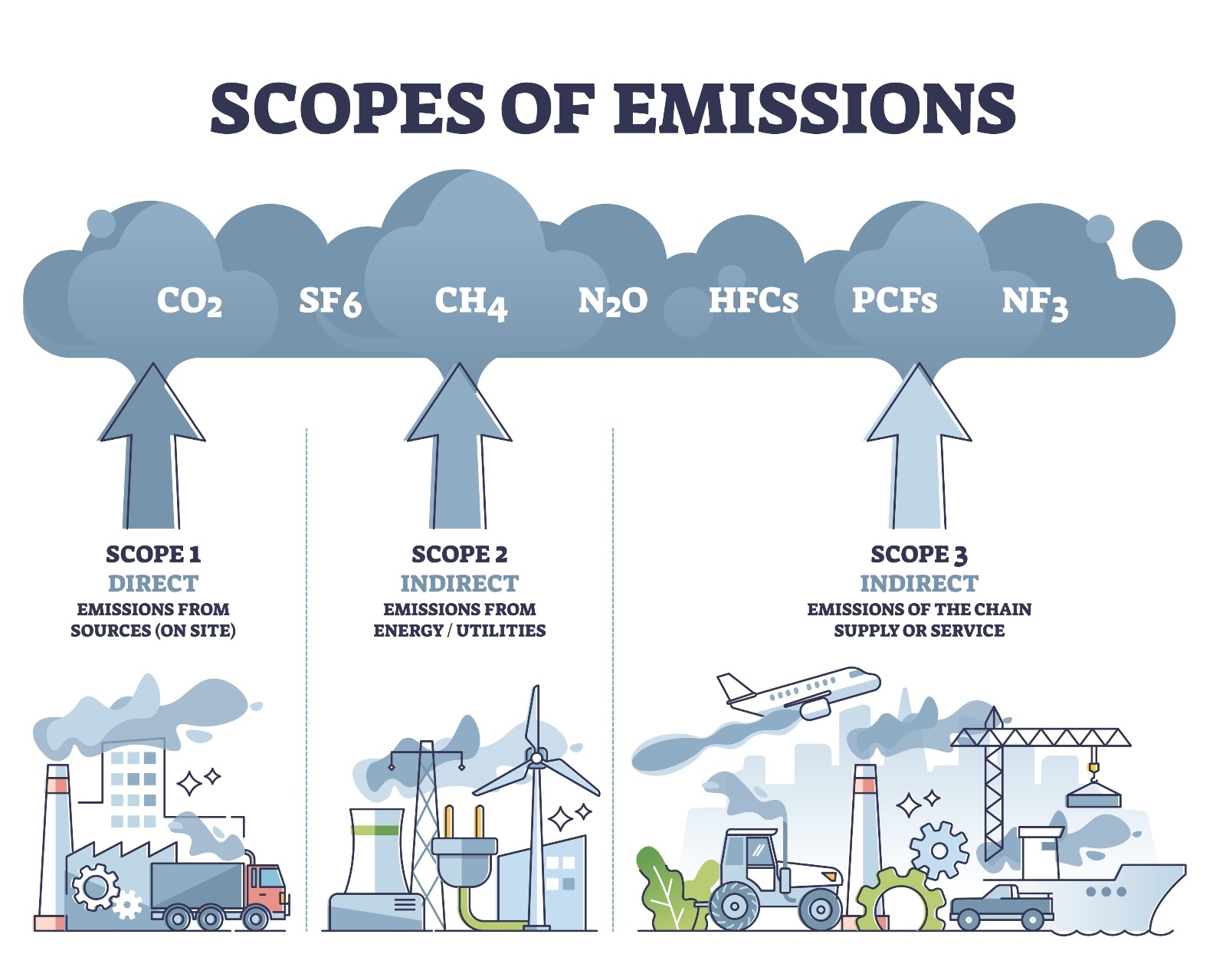

Chinese reports often reference the "Dual Carbon" goals (peaking carbon by 2030, neutrality by 2060). While strictly correct, international investors are looking for specific disclosures on Scope 1, 2, and 3 emissions.

Don’t just say: "We are working hard to protect the green mountains."

Do say: "We are implementing a decarbonization roadmap centered on Natural Capital preservation and biodiversity, fully aligned with the Taskforce on Nature-related Financial Disclosures (TNFD)."

2. Social (S): Contextualizing "Common Prosperity"

This concept is central to Chinese policy but is often misunderstood abroad as purely wealth redistribution.

The Translation Pivot: Translate the intent and mechanism. Describe these initiatives as "Inclusive Growth Strategies" or "Stakeholder Equity Programs."

Why it works: It shifts the narrative from political compliance to a measurable social strategy that reduces systemic risk—a key metric for ESG funds.

3. Governance (G): Clarifying Structure

Terms regarding party committees or internal oversight can be baffling to foreign auditors. These should be articulated through the lens of "Oversight Mechanisms," "Compliance Integrity," and "Board Independence," ensuring the translation reflects the functional governance structure rather than just the administrative title.

The Art of Narrative: Beyond the Spreadsheet

While data is the skeleton of an ESG report, the translation provides the muscle and soul. A rigid, machine-translated report signals a lack of sophistication. A report that flows with "Elegance" (雅) signals a company that is confident, transparent, and internationally mature.

Investors are not just buying stocks; they are buying into a vision of the future. If that vision is obscured by awkward phrasing or "Chinglish," the risk premium goes up, and the valuation goes down.

Bridging the Gap with Artlangs Translation

Achieving this level of precision requires more than just language skills; it demands domain expertise. This is where Artlangs Translation distinguishes itself.

With a legacy of excellence in the language service industry, Artlangs does not simply translate words; we localize value. Our expertise spans:

230+ Languages: Ensuring your ESG message resonates in every market you operate in.

Specialized Localization: From video localization and short drama subtitles to game localization and audiobook dubbing, we understand how to adapt tone for different mediums.

Data & Tech: Our experience in multi-language data annotation and transcription means we understand the AI algorithms that will eventually read your report.

Whether you need to convert a technical environmental report into a compelling investor video, or require precise dubbing for a corporate sustainability documentary, Artlangs brings years of rich experience and a portfolio of successful cases to the table.

In 2025, don't let language be the barrier to your valuation. Let your sustainability efforts speak the global language of value with Artlangs.

Ready to elevate your international profile?

Contact Artlangs Translation today to discuss your ESG localization strategy.